Finance is, basically, the discipline that reveals whether a company is healthy, growing, exposed, or quietly drifting off course.

And its focus is on trying to answer three fundamental questions:

- Are we making money?

- Where are we making it… and where are we losing it?

- Can this model sustain itself over time?

When those answers aren’t clear, every strategic decision carries more risk than it should.

This gets harder as the company grows. Complexity doesn’t arrive politely; it shows up in finance first. New business units. New countries. New billing models. New systems that need to talk to each other. And suddenly, simple reporting turns into exception handling.

This is why SAP FICO matters in so many enterprises. It’s not “a module.” It’s the structure behind how money is recorded, controlled, and explained across the organization.

But there’s a pattern we’ve seen repeatedly over more than twenty years working alongside SAP-driven teams: The more tightly coupled the logic, the harder it becomes to modernize, integrate new tools, adopt automation, or move to S/4HANA without disruption.

Customizations layered over time. Integration shortcuts built under pressure. Controlling structures designed for a version of the business that no longer exists.

The result is friction.

In this article, we share a practical perspective on the current state of SAP FICO across enterprises, where it creates drag, where it creates clarity, and where design decisions ultimately determine long-term value. We also examine the role top FICO consultants play in making that value achievable.

What SAP FICO actually represents inside the organization

SAP FICO brings together two disciplines that are often discussed separately but operate as one system in practice.

Financial Accounting (FI)

FI manages the external view of the company:

- Legal reporting

- Financial statements

- Compliance and audit requirements

This is the version of the truth shared with regulators, investors, and authorities.

Controlling (CO)

CO focuses on the internal view:

- Cost and profit visibility

- Operational performance

- Product and margin analysis

This is the version of the truth leadership relies on to steer the business. What often gets overlooked is that FICO defines the financial operating model of the organization.

Once those structures are in place, every downstream process (planning, reporting, analytics, automation) depends on them.

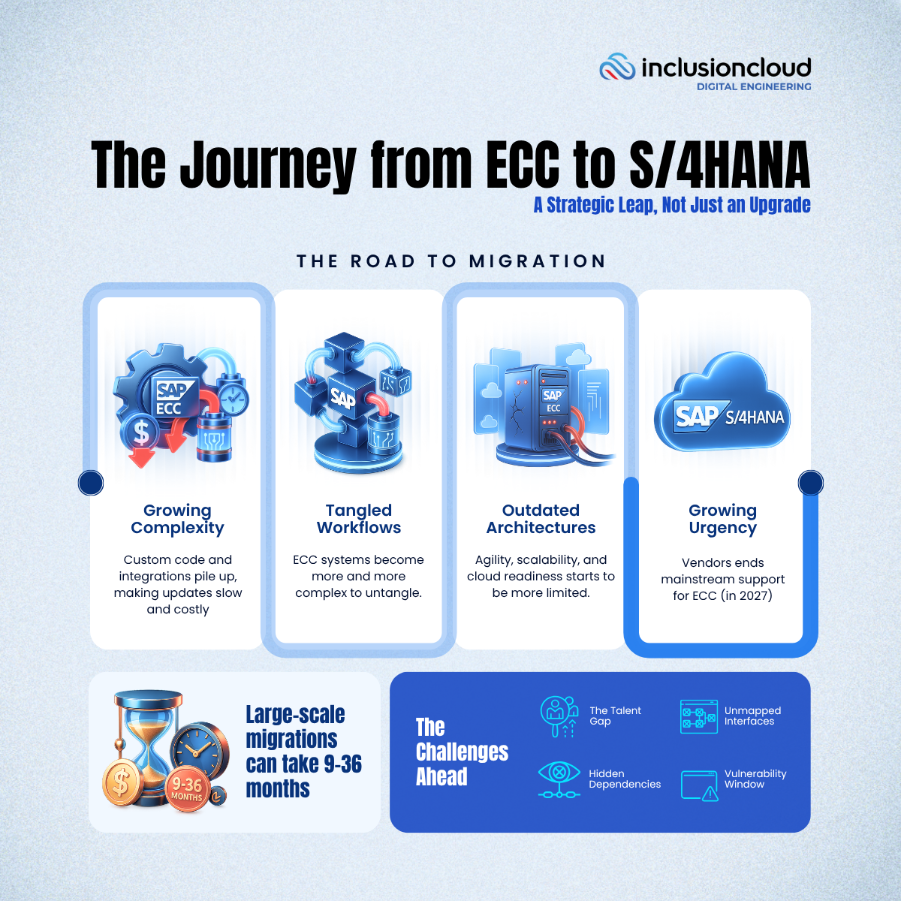

From ECC to S/4HANA: The Evolution of SAP FICO

Historically, SAP FICO was delivered as part of:

- SAP R/3

- SAP ECC

These systems powered finance reliably for decades, but they accumulated complexity over time: reconciliations between modules, duplicated data models, and heavy customization. With SAP S/4HANA, finance changed structurally.

The introduction of the Universal Journal (ACDOCA) unified FI and CO into a single data model. What that means for leaders is simple:

- One source of financial truth

- Real-time reporting

- Fewer reconciliation processes

- Faster closes

Should you move from legacy FICO to S/4HANA Finance?

This question comes up in almost every executive conversation:

“Will this actually make finance run better, or are we signing up for a big project that simply moves us to a newer version?”

The honest answer depends on one thing: how much complexity your financial system is carrying today and how much that complexity is costing you.

In ECC, FI and CO are deeply connected but technically separated. That separation creates a lot of “bookkeeping about bookkeeping.” Data gets stored in different places, aligned later, and reconciled through processes people learn to accept as normal.

As the company grows, that structure gets heavier. You see it in month-end. You see it in reporting cycles. You see it in the number of manual checks required to trust the numbers.

S/4HANA, thanks to Universal Journal, simplifies that structure by design. It doesn’t eliminate work, but it removes duplication that tends to multiply over time.

A move to S/4HANA usually makes sense when finance leaders feel pressure from:

- Slow or fragmented reporting that slows decisions

- Reconciliation effort becoming a constant tax on the team

- Integration complexity increasing with every acquisition or new platform

- A serious push toward automation and AI that depends on consistent financial data

If the system is stable, the business model hasn’t shifted much, and finance isn’t feeling operational drag, urgency may be lower. But even then, the ECC support timeline makes this less optional every year.

When the answer is “yes, complexity is costing us,” S/4HANA becomes a practical step: simplify the financial backbone and reduce the long-term cost of managing that complexity.

SAP FICO and Clean Core: not a contradiction, a discipline

Clean Core often gets misunderstood in finance.

We need to start with the simple fact that finance is rarely standard. Instead, finance reflects the particularities of how a company really runs (how it allocates costs, measures profitability, complies across jurisdictions, and structures management reporting).

Those things evolve, and FICO evolves with them.

So the initial reaction is predictable:

“Clean Core sounds nice, but finance can’t be standard. Are we supposed to erase what makes our model work?”

No.

Clean Core does not mean “no custom code.” It does not mean deleting Z objects in principle. And it definitely does not mean forcing finance into a rigid template that ignores operational reality.

What it does mean is controlling how customization accumulates.

Over the years, most FICO landscapes collect logic for valid reasons. Some enhancements still deliver value. Some exist because the business needed an answer fast. And some are simply still there because nobody has had the time (or political capital) to revisit them.

The issue is not customization. The issue is uncontrolled accumulation and tight coupling inside the core.

When critical logic is embedded deep inside modified standard objects, or depends on non-released exits, you pay for it later: in upgrades, testing, integration stability, and long-term operating cost.

A realistic Clean Core approach in SAP FICO starts with questions leaders can actually use:

- What customizations still create business advantage?

- What customizations exist mostly because “this is how we’ve always done it”?

- Where should business-specific logic live so upgrades don’t feel like surgery

- Are we using released extensibility and decoupled patterns or old exits and deep dependencies?

S/4HANA Finance helps with the data model, but it doesn’t automatically clean the core. If every enhancement is carried forward unchanged, like in a brownfield migration, complexity stays (but just running on a newer platform).

Finance will never be fully standard. And it shouldn’t be.

But it can be structurally cleaner to save you some headeaches and money in the maintaining/modernization moments.

5 Strategic Moves to Get More Value from SAP FICO

We’ve been SAP partners for more than 20 years. During that time, we’ve worked across industries with very different operating models and levels of complexity.

Some organizations were running heavily customized ECC landscapes built over decades. Others migrated that complexity to S/4HANA through brownfield conversions. Some chose a clean start with a greenfield approach. And many opted for a bluefield path, selectively modernizing while preserving critical business logic.

In every case, the technical path was different. But one pattern repeats.

The companies that extract real value from SAP FICO don’t just maintain what they have. They deliberately simplify, realign, and govern their financial core.

Here are five practical moves we consistently see unlock measurable value:

1) Audit financial complexity, not just Z code

Most organizations track Z objects. Fewer track financial logic.

Over time, allocations, parallel ledgers, CO structures, reporting layers, and reconciliation mechanisms accumulate. Each decision made sense at the time. Few were revisited.

Before talking about Clean Core or S/4HANA, start with clarity:

- Which controlling structures still reflect how the business runs today?

- Which reports are actually used to make decisions?

- Which reconciliation steps exist only because of legacy architecture?

- Where are teams manually compensating for structural design choices?

In many enterprises, a significant portion of complexity is historical, not strategic.

Value starts with simplification, and simplification starts with visibility.

2) Apply Clean Core as governance, not ideology

Finance will never be fully “out of the box.” And it shouldn’t be.

Cost allocation models, profitability logic, and regulatory structures are real differentiators. Clean Core does not mean removing all of them.

What it does mean is reducing structural fragility.

In practice, that translates into:

- Avoiding direct modification of standard objects

- Using released extensibility mechanisms

- Decoupling business logic where possible

- Governing new customizations before they enter the core

The issue is not customization itself.

The issue is tight coupling inside the financial backbone.

Every time financial logic is embedded deeply in the core, upgrade cycles become slower. Regression testing becomes heavier. Operating cost increases.

The goal is not to standardize everything and pretend your company operates like any other in the world. That’s not what SAP means by Clean Core.

Applied correctly in FICO, Clean Core makes modernization economically sustainable.

3) If you’re on S/4HANA, stop rebuilding ECC on top of it

This is more common than most leaders realize.

Companies migrate to S/4HANA, adopt the Universal Journal, and then recreate legacy reconciliation logic through parallel reports and custom extracts.

The Universal Journal already unified FI and CO. It removed structural duplication. But if legacy reporting constructs are rebuilt on top, complexity returns.

Extracting value from S/4HANA FICO often means:

- Simplifying redundant ledgers

- Reducing artificial reconciliation steps

- Aligning reporting directly with ACDOCA

- Trusting the unified data model

S/4HANA reduces structural friction. That’s true. But only if you avoid rebuilding your legacy chaos on top of it.

4) If you’re still on ECC, reduce migration weight now

With ECC deadlines approaching, many organizations are in a wait-and-see mode.

That’s a mistake.

The highest ROI improvements often happen before migration:

- Remove unused enhancements

- Standardize master data governance

- Clean up brittle integrations

- Reassess CO-PA structures

- Retire obsolete reports

Every unnecessary element carried into S/4HANA increases migration effort, testing cycles, and long-term operating cost.

Arriving “lighter” changes the economics of the transition.

And it’s an opportunity to reduce technical debt.

5) Treat FICO consultant quality as a strategic lever

Because of the number of SAP programs we support, we interview dozens of SAP consultants every day, many of them FICO specialists.

Over time, this gives you a very clear signal. You stop guessing which skills matter and start seeing which ones actually move the needle for clients.

These are the five skills we consistently see in strong SAP FICO consultants:

1). See the whole flow, not just the ticket.

They can trace one finance outcome end to end: source transaction, postings, derivations, substitutions, allocations, reporting, and downstream impacts. That’s why they solve problems once, instead of creating a new workaround every month.

2). Separate business logic from system habit.

A lot of finance “requirements” are really legacy habits that turned into rules. Seniors challenge them respectfully. They ask “What decision does this support?” and “Do we still need it?” That’s where simplification starts.

3). Think in operating models, not configuration screens.

They don’t get stuck in “which setting fixes this.” They zoom out: What is your controlling model trying to achieve? What does your margin logic need to be trustworthy? What structures will still make sense after the next acquisition?

4). Predict upgrade pain before it shows up.

This is where experience matters. Seniors can look at a customization and tell you, immediately, if it will slow your next upgrade, complicate testing, or break clean extensibility paths. They design with tomorrow’s constraints in mind.

5). Reduce complexity without breaking finance.

Not by preaching “go standard,” but by making complexity intentional. They know what must remain unique, what can be simplified, and what needs to be moved out of the core to keep the backbone stable.

That’s why most enterprises hit the same wall.

Why We Built inMOVE™ By Inclusion Cloud for SAP FICO Programs

When you support SAP programs at scale, you develop a certain instinct.

After more than 20 years as SAP partners, and having worked with over 160 organizations across industries, we’ve seen SAP FICO in almost every possible shape.

Because of the volume of SAP programs we support, we interview dozens of SAP consultants every day. Many of them are FICO specialists. Over time, that repetition becomes a kind of training.

That exposure taught us something important. The definition of a strong SAP FICO consultant has changed.

Not because finance became simpler. Quite the opposite. But because the way consultants interact with systems has evolved.

Today, AI is already part of everyday work. Consultants use it to explore configuration options, read SAP documentation faster, sanity check ideas, or unblock themselves when the system gets opaque. This is not a future trend. It is happening right now, on active projects.

We see this clearly in interviews. Many candidates rely on AI in one form or another, whether they say it openly or not. Today, roughly 65% of job candidates use AI at some point during the application process, and that figure continues to rise.

AI itself is not the problem.

The real issue is that traditional interviews no longer separate experience from assisted ones. Fluency is easy to fake. Judgment is not.

That gap is what pushed us to build inMOVE™ by Inclusion Cloud.

We designed it specifically for SAP programs like FICO, where the cost of a weak decision rarely shows up on day one. It appears later, through accumulated friction, rework, and constraints that only emerge at scale.

We use AI where it makes sense, to reduce noise and accelerate matching. But we never let it replace human evaluation.

Every consultant goes through a double validation process. First, with HR specialists who verify background, context, and consistency. Then with senior SAP technical leaders.

AI can be part of the process. What matters is understanding how someone reasons when the system pushes back, and there is no obvious answer.

A strong FICO consultant can use AI and still explain why a design choice will cause friction three releases from now. A weak one collapses the moment the conversation moves beyond surface-level configuration.

At the end of the day, our responsibility is simple.

Whether AI is used or not, our job is to identify SAP FICO consultants with real, provable experience. People who improve financial processes, reduce structural risk, and help organizations get more value from their SAP landscape over time.

That is what inMOVE™ by Inclusion Cloud was built to do.

The Bottom Line

SAP FICO is the structural backbone of how your organization records, allocates, analyzes, and governs financial reality.

If that backbone is:

- Overly coupled

- Historically layered

- Hard to upgrade

- Expensive to maintain

Then every strategic move becomes heavier than it needs to be.

But it can be structurally cleaner, and that directly reduces headaches and costs during maintenance, upgrades, and modernization cycles.

That’s where real value sits:

Not in adding more features.

In reducing structural friction.

And that requires discipline in architecture, clarity in financial design, and the right expertise at the table.

If you’re evaluating your SAP FICO landscape (whether to simplify, modernize, or prepare for S/4HANA) it’s worth asking:

Is our financial core enabling growth?

Or just sustaining history?

If you are rethinking how SAP FICO supports your business, or need experienced FICO consultants to move faster with less risk, let’s talk.

What SAP FICO services does Inclusion Cloud provide?

Inclusion Cloud delivers senior SAP FICO consulting for finance optimization, ECC to S/4HANA migrations, Clean Core–aligned redesign, and ongoing support. We help finance leaders reduce structural complexity, control upgrade risk, and improve long term operating efficiency.

How does Inclusion Cloud support SAP FICO transformations?

We support finance transformations by redesigning controlling structures, simplifying legacy customizations, preparing systems for S/4HANA Finance, and aligning FICO with Clean Core principles. The focus is operational stability and measurable cost control, not cosmetic change.

What is inMOVE™ by Inclusion Cloud?

inMOVE™ by Inclusion Cloud is our AI assisted talent delivery model. It combines intelligent screening with senior human validation to identify certified SAP FICO consultants who match the technical and business context of each project.

How can Inclusion Cloud deliver SAP FICO consultants in 72 hours?

Through inMOVE™ by Inclusion Cloud, we maintain a continuously validated pool of certified SAP FICO specialists. Candidates are pre assessed technically and reviewed by senior SAP experts, allowing us to present qualified consultants within 72 hours.

What types of SAP FICO consultants can Inclusion Cloud provide?

We provide functional FICO consultants, S/4HANA Finance specialists, transformation leads, integration focused finance architects, and subject matter experts in areas such as asset accounting, CO PA, and group reporting.